Dear JSA,

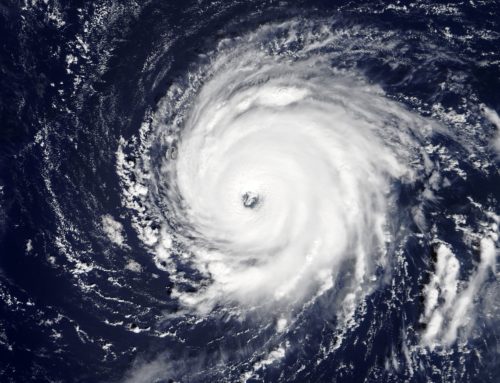

What does “shut down for binding” because of a hurricane mean?

Sincerely,

Hazy about Hurricanes

Dear Hazy,

When the threat of a damaging hurricane approaches your area, and Jim Cantore is close by, it may be confusing to know what we’re talking about when we say we’re “shut down for binding.” It does NOT mean that we’re closed. It means that our binding ability is suspended due to guidelines our carriers have given us. Specifically, it means that we must cease binding any property, inland marine, physical damage or cargo policies. This restriction applies to new business, requests for increase limits, or requests to add additional coverages on those types of policies.

JSA’s carrier companies will cease binding as a storm approaches, each one determines when they will cease binding. JSA will continue to carefully evaluate our available markets until there are none left. A carrier’s moratorium remains in effect until it is officially lifted through written correspondence and is subject to change based on the course of the storm. Coverage can not be backdated, endorsements to existing policies may be limited, and outstanding quotes may be withdrawn from binding coverage during that time.

Note that this does not apply to renewals – UNLESS there’s been a lapse in coverage. However, we STILL can’t increase limits or add additional coverages to renewals during this time.

This restriction also does NOT apply to liability coverages. We are still able to bind General Liability, Auto Liability, or other liability policies.

The moral of this story is: before hurricane season, make sure your policies are current and renewed well before being “shut down for binding” even becomes an issue.